Table of Contents

Summary

ChatGPT is the latest in a line of generational AI that is set to revolutionize the way we interact with machines. It uses natural language processing to understand and respond to customer queries in real-time. It can help streamline your internal processes, such as claims management, and policy underwriting, by automating repetitive tasks. It can also help you explore new product offerings or target markets and much more.

ChatGPT

Unless you are Punxsutawney Phil, and are still hiding in your burrow, you have heard about ChatGPT. ChatGPT, is the latest in a line of generational AI that is set to revolutionize the way we interact with machines. Remember HAL in 2001: A Space Odyssey, C3P0 in Star Wars, or Samantha in Her, movies have long explored the potential of AI, and now we are seeing it become a reality. With ChatGPT, we can engage with machines in a way that feels natural and intuitive, opening up a world of possibilities.

The ChatGPT rush reminds me of the movie “The Good, The Bad, and the Ugly.” The film centers on the greed violence and lawlessness of the American West during the Civil War. It’s like the AI wars we see now between OpenAI, You.com, Microsoft, Google, and more.

A Little Background

Generative AI is a type of artificial intelligence that can create new content, such as text, images, or audio. This is done by training a model on a large dataset and then using it to generate new content based on existing patterns or styles found within a dataset. It’s like having an expert analyst who can quickly identify trends, correlations, anomalies, outliers or other valuable information buried deep inside the data set; then use those findings as input into predictive models which can help you better anticipate customer needs before they arise – allowing you to stay ahead of the competition while providing more tailored services at lower costs than ever before!

As an example, I asked Dall-E to create an image of “a female insurance agent at a farm in front of a cow being milked” and this is what it created.

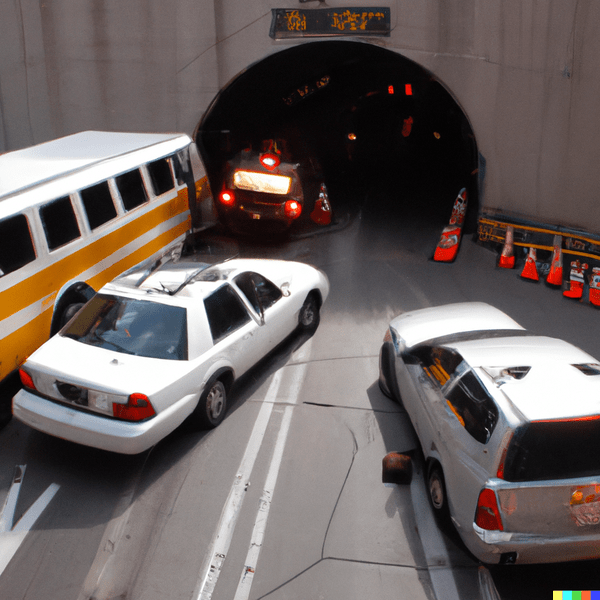

As the process improves, will fraudsters start to submit evidence of “a 3-car accident at the entrance to the Brooklyn Battery Tunnel”?

To chat or not to chat

First, let’s start with the good news. ChatGPT is an incredibly powerful tool that can revolutionize the way you do business. It is an innovative AI language model that uses natural language processing to understand and respond to customer queries in real-time. This means that it can help streamline your internal processes, such as claims management, and policy underwriting, by automating repetitive tasks and providing quick and accurate insights.

But that’s not all! ChatGPT can also help you better engage with your customers, agents, and employees. By providing them with immediate and personalized assistance, you can improve their experience and increase satisfaction. This can lead to greater loyalty, positive reviews, and more referrals.

Here are some areas where ChatGPT could help drive efficiencies, customer, and agent experience, and expand business:

- Automated customer and agent service: Insurance carriers can use ChatGPT to automate their customer and agent service operations. By training the model on a large dataset of customer or agent inquiries and responses, ChatGPT can generate proper responses to common customer inquiries. This can include answering questions about coverage, processing claims, and supplying policy information. By using ChatGPT for automated customer service, carriers can handle a higher volume of interactions without the need for added human staff. This can lead to cost savings, improved efficiency, and increased customer satisfaction due to faster response times.

- Underwriting: ChatGPT and generative AI can also be used in the underwriting process. This can include generating policy documents, such as policy summaries and declarations pages, and other underwriting materials. By using the technology to automate document creation, carriers can reduce the time and effort needed for manual document creation. This can improve accuracy and consistency, as well as lead to cost savings. Additionally, ChatGPT and generative AI can be used to analyze data and make underwriting decisions, such as determining risk levels and premium pricing.For instance, if you are thinking about understanding the new or emerging risks facing the construction industry, you could ask: “what are some of the new risks emerging in the construction industry that might arise to new insurance claims” and here is a snippet of what ChatGPT returns:

The construction industry is constantly evolving, and with new technologies and materials come new risks and challenges. Here are some emerging risks in the construction industry that could lead to new insurance claims:

-

-

-

Cybersecurity: As construction companies increasingly rely on technology, they become more vulnerable to cyberattacks. A breach of sensitive data, such as building designs, financial records, and employee information, could result in significant financial losses and reputational damage.

-

Drone operations: Drones are being used more frequently on construction sites for tasks such as surveying and inspection. However, drone operations pose unique risks, including the risk of crashes, privacy violations, and property damage.

-

Prefabricated construction: Prefabricated construction methods are becoming more popular, but they come with their own set of risks. For example, prefabricated materials may be more susceptible to damage during transportation and installation, leading to increased insurance claims.

-

-

While this isn’t detailed, it could help underwriting and product teams identify potential risks for which they haven’t fully accounted for in underwriting guidelines and/or pricing.

- Fraud detection and prevention: I already showed a potential example of how bad actors could use ChatGPT, but it can also be used for fraud detection and prevention. By analyzing substantial amounts of data, the technology can detect patterns and anomalies that may indicate fraud. This can include identifying suspicious claims, detecting fraudulent policy applications, and identifying other forms of fraud.

- Marketing and communication: ChatGPT can also be used to generate personalized and engaging content for marketing and communication purposes. This can include generating highly targeted marketing campaigns, personalized customer communications, and other forms of content. By using the technology to generate personalized content, carriers can increase customer engagement and retention. Additionally, ChatGPT can be used to generate engaging and informative content for your website, social media channels, and other digital platforms, helping to increase brand awareness and build trust with potential customers and agents.

- Product and territory expansion: What if you want to expand to a neighboring state? You could use ChatGPT to find states or counties within a state that have higher likelihood of having customers you want to target. I asked ChatGPT “my best customers are married, 57 with household income of $245000 and own their home and a small boat. What counties in WI should I market to where I’m likely to find similar customers?” Here is what it came back with:

According to the US Census Bureau’s American Community Survey, some of the counties in Wisconsin that may have a higher concentration of households with similar characteristics to your best customers include:

-

-

-

Ozaukee County: This county is located just north of Milwaukee and has a median household income of $89,804, which is one of the highest in the state. The county also has a relatively high homeownership rate of 76.9% and is known for its proximity to Lake Michigan and its boating opportunities.

-

Waukesha County: Located just west of Milwaukee, Waukesha County has a median household income of $86,396 and a homeownership rate of 73.5%. The county is known for its picturesque lakes and waterways, making it a popular destination for boating enthusiasts.

-

Door County: Located in the northeastern part of Wisconsin, Door County is known for its scenic beauty and outdoor recreation opportunities. The county has a median household income of $60,394 and a relatively high homeownership rate of 73.9%.

-

Washington County: This county is located just north of Milwaukee and has a median household income of $78,063 and a homeownership rate of 75.9%. The county is home to several lakes and rivers, including the Milwaukee River, making it a popular destination for boaters and fishermen.

-

Vilas County: This county is located in northern Wisconsin and is known for its natural beauty and outdoor recreation opportunities. The county has a median household income of $53,063 and a homeownership rate of 71.8%. Despite having a lower median household income, the county may still be attractive to your target customers due to its popularity among boaters and outdoor enthusiasts.

-

-

When I then asked it to tell me how many prospects there are in those counties (after some refinements to my questions) it came back with this:

Based on the most recent estimates from the United States Census Bureau for each of the counties, the estimated number of adults (18 years or older) living in these counties are:

-

-

-

Ozaukee County: 69,100 adults (78.2% of the population)

-

Waukesha County: 309,138 adults (76.1% of the population)

-

Door County: 20,466 adults (74.8% of the population)

-

Washington County: 107,083 adults (78.3% of the population)

-

Vilas County: 16,184 adults (75.1% of the population)

-

-

Some cautionary notes

Now, let’s move on to the bad news. If you’re not careful, ChatGPT can put you out of business. AI is no longer a novelty; it is becoming an industry standard. According to a recent study by Accenture, while many insurers surveyed say that AI is a top priority for them, less than half say their organizations are advanced with these technologies. This compares to the fact that Insurtechs that use AI, machine learning, and related technologies as their primary technology source raised 20% more investment each year (CAGR) from 2015-2020. And, let’s be honest, we’re already in 2023! AI is not only here to stay, but it is also quickly becoming a must-have technology in the industry.

The main threat that ChatGPT presents to regional insurance carriers is the potential for large national carriers to use it to their advantage. National carriers have already invested in AI technology, and they have the resources to take advantage of it. If they improve their internal processes and customer experience faster than you, they will gain a competitive advantage over smaller carriers.

But this isn’t the only threat. ChatGPT can also be used by Insurtech companies that are looking to disrupt the traditional insurance market. Insurtech companies are known for their innovative and agile approach, and they are not afraid to use the latest technology to improve their offerings. If Insurtech companies start using ChatGPT to improve their customer service and claims management processes, they can quickly gain market share.

The path forward

So, what can you do to protect yourself from the threat of ChatGPT? Here are a few strategies that you can use:

Embrace ChatGPT, but don’t throw the baby out with the bath water: The best way to protect your business from the threat of ChatGPT is to use it to your advantage. By embracing AI technology, you can improve your internal processes and customer and agent experiences, and gain a competitive advantage over insurtechs and other national and regional carriers. However, remember, there are facets to your business that others can’t replicate. Where proper, enhance those with ChatGPT.

- Use Data Analytics: ChatGPT relies on data to supply accurate insights and responses. By using data analytics to better understand your customers, you can provide them with more relevant and valuable information. This can improve customer satisfaction and retention.

- Leverage Your Regional Advantage: Regional carriers have the advantage of local knowledge and understanding. Use this advantage to your advantage! Focus on providing products and services that are tailored to the needs of your local customers.

- Focus on Personalization: While ChatGPT is great at automating tasks and responding to customer queries, it is not particularly good at providing personalized advice. This is where regional carriers can really shine. By focusing on providing personalized advice and tailored solutions, you can differentiate yourself from national carriers and Insurtech companies.

- Invest in the Right Technology: While ChatGPT is a powerful tool, it is not the only AI technology out there. Make sure that you invest in the right technology for your business. This may include tools for data analytics, fraud detection, and risk assessment. By investing in the right technology, you can improve your business processes and stay competitive in the market.

- Prioritize Human Interaction: While ChatGPT is great at automating tasks and supplying quick responses, it is important not to forget the value of human interaction. Make sure that your customers and agents have access to human agents when they need them. This can help build trust and improve the overall customer experience. Deploy ChatGPT features to enhance and not replace your ability to provide human interaction.

- Keep an Eye on the Competition: Keep an eye on what your competitors are doing with ChatGPT and other AI technologies. This can help you identify potential threats and opportunities in the market.

ChatGPT presents both threats and opportunities for insurance carriers. By embracing AI technology and focusing on personalized customer and agent service, regional carriers can gain a competitive advantage over national carriers and Insurtech companies. However, it is important to invest in the right technology and prioritize human interaction to stay competitive in the market.

There are two lines from The Good, The Bad, and the Ugly, that I think summarize the environment we find ourselves in and what you need to do:

Blondie (Eastwood) said: “You see, in this world there’s two kinds of people, my friend: Those with loaded guns and those who dig. You dig.” By engaging in some of the above areas, you will ensure that you are the ones with guns.

And Tuco (Wallach) who said: ““When you have to shoot, shoot. Don’t talk.” In other words, now is the time to act. Don’t spend too much time debating or observing.

But we should aways remember what HAL said. “I know I’ve made some very poor decisions recently, but I can give you my complete assurance that my work will be back to normal.” – HAL’s attempt to reassure the crew after its earlier malfunction

I hope you found this email informative and helpful. If you have questions or want to discuss how ChatGPT and other AI technologies can help your business, please reach out or book a time to meet by clicking here.

Kaenan is a professional in the areas of block chain, telematics, wearables, analytics, artificial intelligence (AI) and Insurtech. He has played a key role in innovating many start-ups and established carriers. His advice has been widely appreciated in the financial community, which resulted in multiple quotes and publications in various media.

Most recently he was Practice Lead for Innovation, Fintech, and Strategic Insights at EY. Throughout his career he has held leading roles within Marketing Strategy and Decision Management with top Insurance, Banking and Finance companies, including USAA, Citibank and Sallie Mae.