Lemonade and Root announced their third-quarter results this week. There were some positive developments for both companies, but there are still many challenges ahead for both. Indeed, their results remind me of a quote from former President Harry Truman: “It doesn’t matter how big a ranch you own or how many cows you brand, the size of your funeral is still gonna depend on the weather.”

Insurtechs this year are tinkering on the edge of survival. Many believed growth was the ultimate goal, but the wind has changed and markets and investors have changed their appetite. Unfortunately, so many Insurtechs will be buried this year.

Table of Contents

The Results of Lemonade

Lemonade completed the acquisition of Metromile earlier this year, and to their advantage they can report stronger results due to Metromile than they could have reported on their own. At least their cash burn rate was neutral due to the $164.8 million in cash they received as part of the acquisition.

I am surprised by the fact that many of the public startups and well-financed private Insurtechs are sitting with a pool of money, and very few external acquisitions are made either by private equity or a traditional carrier. You could buy these Insurtechs, strip them down to their core assets and pay for the acquisition with cash they had on hand.

Lemonade now has 1.8 million customers, a growth of nearly 200k over the last quarter. Their in-force premium reached $609M, much of the increase over Q2 was attributable to Metromile’s book. Lemonade also saw Metromile’s advantage in the fact that its average premium per customer increased by 35% from 3Q21 to $343. However, when you compare this number to Root’s number of $1150 (discussed below), we get a sense of how little premium the average Lemonade customer really generates.

Not everything is as wonderful as a blooming lemon grove. Their gross loss ratio rose to 94% and their net loss ratio was over 100 points. They continue to bleed with a $91.4 million net loss in the last quarter.

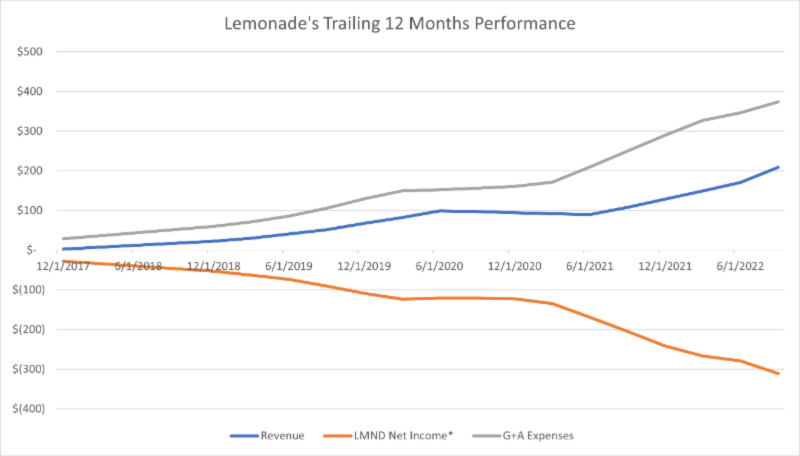

If we look at the results of the last twelve months, which compensate for seasonality, we see a picture in which the net income losses seem to continue to accelerate. If we calculate the trend line for both revenue and net income, we see that net income (actually loss) is growing more than 60% faster than revenue growth (slope coefficients of 0.1 vs. 0.16). This suggests that they have not learned the lessons of President Truman.

The Power of Pets

Carl Ichan, the famous corporate raider once said: “You learn in this business: It you want a friend, get a dog.” My friend growing up was Lance, my German Shepherd. And we were certainly not business partners – until I had to share leftovers.

In their investor letter, Lemonade emphasizes their agreement with Chewy The Pet Food and Supply Company to embed their pet insurance in their sales machine by 2023. It seems like they are chasing a friend with lower distribution costs.

Chewy’s revenue share compensation consists of a few components but will be paid out primarily in the form of equity over the term of the contract. This structure aligns our interests, with Chewy incentivized to drive sales of Lemonade Pet and deliver long-term growth with minimal cash burn for Lemonade.

It will be interesting to see how the compensation structure is aligned in a world where their share price may not appreciate, or rather may fall? Will Chewy still be interested in investing in a relationship that could cost them money? Speaking of costs, Lemonade reported that they spent $6.6 million to cover severance costs for Metromile employees laid off as a result of the merger.

Root

As a former Calgarian who grew up around the oil industry, T Boone Pickens had a good reputation. Root’s results reminded me of a quote I heard from him: “Work eight hours and sleep eight hours and make sure that they are not the same hours.” In Root’s early life, it seemed like they were asleep at the wheel. They were paying too much for unprofitable customers. They spent last year re-evaluating their products and portfolios, and we’re seeing the results. They shrank by just 42k customers from last quarter to the end of this quarter with 255,279 customers. Similarly, GWP declined by about 25% to $151M compared to the comparable quarter in 2021. Their net loss shrank to $64M for the quarter from $90M for the last quarter. On the positive side, their loss ratio improved to 79.5% and the average premium increased by 17% to $1150.

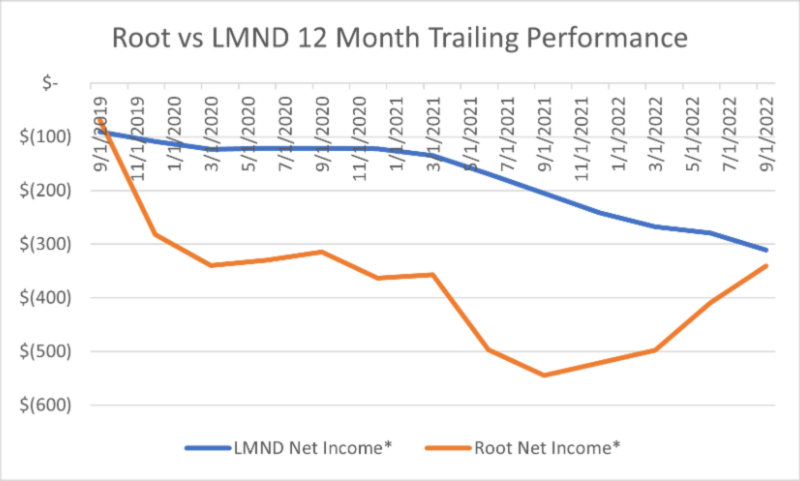

If we look at the performance of the last 12 months, we can assume that the net loss will continue to improve, and within a year or so they could be cash neutral.

The Hybrid of Embedded

Embedded Insurance seems to have prevailed for them. 38% of all new policies sold came from their partnership with Carvana, which has enabled them to shrink marketing from $246 million in the third quarter of 2021 to $46 million this quarter.

I share a direct quote from their shareholder letter because it encapsulates the essence of how embedded insurance, if successful, has become the mantra of most product-based Insurtechs and MGAs.

Through our partnership, we have also gained a greater understanding of Carvana’s customers, who on average have higher coverage limits, better commitment to the first term and have favorable trends in the loss ratio compared to our direct customers. We attribute this advantage to both their knowledge of the condition of the vehicles at the time of purchase and the type of buying experience. We believe that the embedded channel offers a differentiated, customized sales approach with attractive conversion rates, acquisition costs and underwriting rates.

Closing Thoughts

The public markets have clearly selected a winner among the early Insurtechs, and it is Lemonade. Although the share price has fallen by more than 70% this year alone, it is still only slightly below their IPO price. Root and Hippo have both suffered in the public markets, both this year and below their IPO price.

The last chart compares Lemonade’s historical 12 months trailing results with that of Root and what we see is that while Root is losing more money than Lemonade, it seems to have turned a corner and its losses are beginning to shrink. They seem to have better control of distribution and operating costs and have taken significant steps to write the ship. Only time will tell whether one of the early Insurtechs companies can transform from a technology company to a insurance company.

The real winners of the future will be Insurance companies that use technology to gain a competitive advantage in an ever-changing world, whether that be an advantage in developing a new product, or a moat for a product or segment they already serve. Please reach out if you want to explore what is on the horizon that you could leverage to help grow your premium and/or reduce expenses while maintaining a high level of customer and agent satisfaction.

Kaenan is a professional in the areas of block chain, telematics, wearables, analytics, artificial intelligence (AI) and Insurtech. He has played a key role in innovating many start-ups and established carriers. His advice has been widely appreciated in the financial community, which resulted in multiple quotes and publications in various media.

Most recently he was Practice Lead for Innovation, Fintech, and Strategic Insights at EY. Throughout his career he has held leading roles within Marketing Strategy and Decision Management with top Insurance, Banking and Finance companies, including USAA, Citibank and Sallie Mae.