Last week, I had the privilege of speaking at the 115th Mid-Atlantic Mutual Advantage Conference, a biennial conference that brings together mutual insurance business leaders large and small to discuss industry trends. As I drove the 7 hours to West Virginia, two songs kept coming to mind: Country Roads by John Denver and Carefree Highway by Gordon Lightfoot. This was my first road trip to WV and John Denver summed up my feelings: Country roads have always brought me home, and the mountains even more. More on that later along with the connection to Gordon Lightfoot.

Insurtechs Lemonade and Root last night announced their results for the second quarter of 2022, saying they had both seen improvements in their results, but significant challenges remain.

In my presentation to MAMAC, I highlighted the work done by the 128-year-old Panhandle Farmers Mutual from Moundsville WV with its renters product.

According to Demotech, Panhandle wrote $3.2 million to GWP within WV last year and has a surplus of $5 million. This pales in comparison to the $373 million in GWP that Lemonade wrote and its surplus of $99 million. Given the size difference, how much do you think Panhandle has spent on developing its renter’s product and platform? I suspect this was less than Lemonade spent on coffee and snacks for it’s employees last year. You can get an instant quote with just your name and address and 3 other questions.

Why is this important, because if a small mutual one-state carrier can create a modern direct application… so can you. What are you waiting for? Reach out if you would like to learn more.

Table of Contents

2Q 2022: Let them eat lemon meringue pie

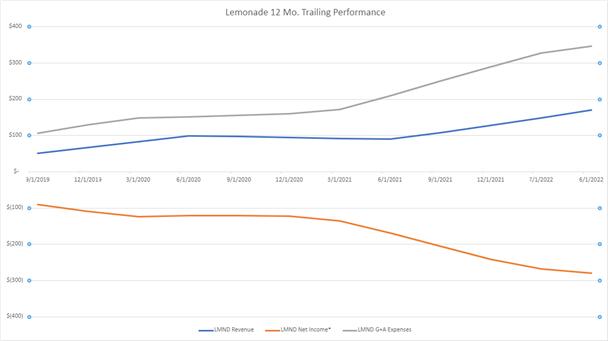

Lemonade recorded an in-force premium of $458 million, resulting in a net loss of $68 million for the quarter and a net loss of $143 million for the first half of 2022. TTM data from the last twelve months reveals a persistent divergence between revenue, G & A expenditure and net income. Lemonade’s spending and loss ratios outpace revenue growth.

Lemonade said in their shareholder letter that they are “fully funded,” meaning that they have slowed hiring and growth spending and that they have enough additional capital to hold them until they are profitable. One thing they are touting, and that contributes to this, is that in exchange for $145M in shares, they have received $155M in cash from the Metromile acquisition.

However, the claim to have enough cash available to make it profitable is not supported by another statistic cited in their consolidated cash flow statement. At the end of June 2021, they had $1,093 million cash, including restricted cash. By the end of June 2022, this figure had dropped to $200 million, with an additional decrease of $70 million this quarter alone. With a TTM net loss of $279 million, it is difficult to see how they have a long runway.

Lemonade said it had 1.58 million customers at the end of June 2022, an increase of 75,739 customers per quarter. Annual premium per customer rose 4% from 1Q22 to $290, and this quarter they spent $37 million on sales and marketing, equivalent to a customer acquisition cost CAC of $489 per new customer. Extrapolating their quarterly revenue of $50 million, and given their 1.58 million customers, this means they earned $31.6 per customer in the quarter, but also lost $43 per customer in net income/revenue. Annually, this means that they earn about $126 per customer, while their annual net loss per customer is $172. If we assume that the average customer stays with Lemonade for 5 years and ignore the fact that their net loss implies per customer, they are unlikely to achieve profitability, their LTV / CAC ratio is a paltry 1.03.

Root’s Carefree Highway

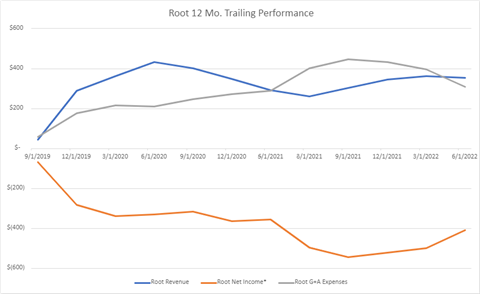

Gordon Lightfoot’s song Carefree Highway has as its chorus the following line: “Carefree highway, you’ve seen better days.” On the one hand, Root has seen much better days. They used to be much bigger in terms of GWP and staff size. On the other hand, Root has begun to tame its spending base, and its loss ratios are generally falling.

Like any other car insurer, Root faced significant challenges last year. Inflation, loss costs, and capital markets have reduced profitability in the auto insurance segment. Unlike Lemonade, Root reduced marketing spending by 77% in the first quarter to $25.4 million in the second quarter but increased spending from $14.7 million in the first quarter of this year.

Unlike Lemonade, they reduced their annual net loss last year, but still lose $1.16 for every dollar of revenue versus Lemonade’s loss of $1.63 per dollar of revenue. Given that they lost 38K customers this quarter, it’s impossible to tease out their CAC from the reported data.

The Power of Highways

Why have mutual carriers existed since 1752? Because they began largely in rural communities and always focused on supporting their local communities. Indeed, the largest Carrier, Statefarm, is a mutual that began 100 years ago.

Why did Insurtechs find it difficult to gain a profitable foothold? Because they focused on selling in the cities and also on people who were technologically savvy, ignoring the fact that country roads lead to many beautiful places and that these places have good insurance risks.

That’s not to say that regional carriers cannot learn from the Insurtech ecosystem. Look at Panhandle Farmers Mutual. They borrowed from what they saw and implemented a direct product for the renter that competes with the best of Insurtechs.

Please contact us if you would like more information.

Insurtech Advisors helps regional carriers and agencies to collaborate with the best Insurtechs that will enable you to succeed and continue to meet the needs of your members, employees, and independent agents. We know your company and the Insurtech landscape. We save you countless hours of wasted time and false starts. We also work closely with your team to identify opportunities and then introduce you personally to the best Insurtechs to pilot.

Kaenan is a professional in the areas of block chain, telematics, wearables, analytics, artificial intelligence (AI) and Insurtech. He has played a key role in innovating many start-ups and established carriers. His advice has been widely appreciated in the financial community, which resulted in multiple quotes and publications in various media.

Most recently he was Practice Lead for Innovation, Fintech, and Strategic Insights at EY. Throughout his career he has held leading roles within Marketing Strategy and Decision Management with top Insurance, Banking and Finance companies, including USAA, Citibank and Sallie Mae.