Scott Eblin, a sage executive coach, wrote a book entitled “The Next Level.” His primary thesis is that the skills that have promoted you are not the skills you need in your new role, and even more so for startups. Generally speaking, the skills needed as a founder are not those required to run a fully-fledged public company, especially in the current market, where almost all public Insurtechs are trading at a small fraction of their original stock market valuations. The HSCM Public Insurtech Index is down more than 50% this past year.

Last week, there were two announcements that Insurtech founders will step aside to allow new talent. Assaf Wand of Hippo stepped down as CEO to become Executive Chairman. His successor Rick McCathron who has been president of Hippo since 2017 and joined Hippo as part of the acquisition of First Connect Agency will take over. This seems to be a transition, a few years in the making. And in the end, Assaf will be able to focus on what he has done amazingly well – develop the strategy for the future and where Hippo should focus its efforts and new products.

On the other hand, GoHealth, a Medicare-oriented digital health company, replaced its co-founder and CEO Clint Jones with Vijay Kotte. At the same time, they announced a new CFO, Jason Schulz. Both previously worked at DaVita Medical Group. However, this change was not planned for and is most likely the result of a share price below one dollar.

This trend of replacing co-founders among stumbling public start-ups is industry-independent, with Payoneer, a digital payments company, replacing its co-founder CEO Scott Galit with former Alibaba President John Caplan, in which case they will work together as co-CEOs next year.

Table of Contents

Cratered Valuations

The fact that so many public Insurtechs are trading at a fraction of their initial price will undoubtedly have a ripple effect on the market. Apart from the expected slowdown in funding, these Insurtechs will have to transform their business models, and perhaps most interestingly, there may be opportunities for M&A that did not exist before.

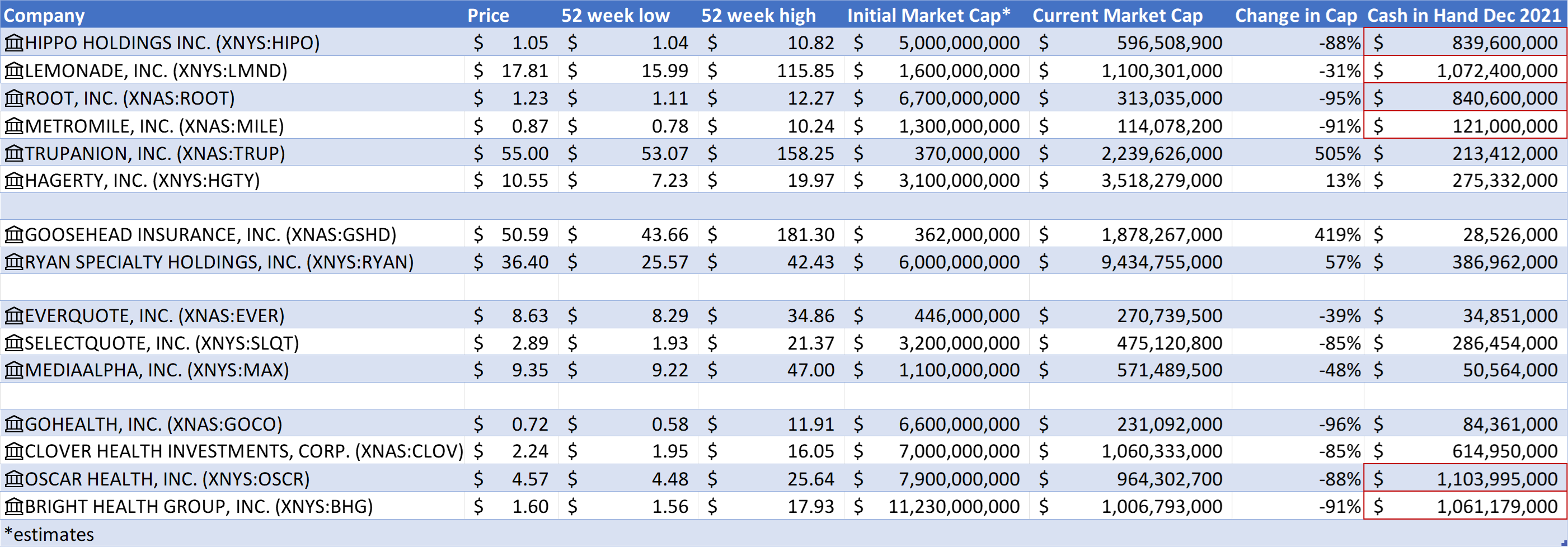

Table 1 shows the share price, market capitalization and available money for selected public Insurtechs. It is striking that almost all of these shares are trading very close to their 52-week lows. Furthermore, all but four of them have a current market capitalization between 31% and 96% below their IPO valuations.

Table 1: Selected public Insurtech metrics 6/12/2022

Impact

As we will discuss shortly, the current market situation yields three primary outcomes.

- Insurtechs will have to save money and make strategic decisions around growth, profitability, and market direction.

- VCs and other sources of equity will scrutinize new and additional investments, and only the strong will survive.

- The cash-on-hand holdings of 6 of these companies exceed their current market capitalization.

Cash is king

Since all of these Insurtechs are losing money year after year, preserving the cash will be critical to their long-term survival. Two issues have developed: downsizing the company and reducing marketing spending. Even the best performing stock, Lemonade, have begun to lay off employees. Root laid off 20% of their workforce earlier this year. Bright Health is laying off 5% of its workforce and leaving states. Metromile began laying off employees before its public debut.

Almost all of the Insurtech reports to shareholders and quarterly reports speak of the need to reduce marketing and other expenses. Insurtechs, some, like Root, even turned away from direct customer acquisition in order to reduce customer acquisition costs.

Slowdown in VC funding

Last week Branch announced a funding round of $147 million with a valuation of just over $1B. Money is still flowing. However, as reported by CB Insights, funding activity has declined 58% in 1Q2022. The only common denominator is that VC investors are looking for steady and predictable growth, ideally with profitable unit economics. Or at least a clear path to profit. An Insurtech-focused VC, which I know, has not made an investment since December 2021 and is sitting on its money, expects continued devaluation.

Emperors love cash

Hippo, Lemonade, Root, Metromile, Oscar and Bright Health all have more cash in hand than their market capitalization. WOW. On the plus side, these high cash levels allow these Insurtechs to continue to survive rather than close their doors or sell at distressed levels. However, as I have already reported, they have less than 3 years of runway at their current burn rates at best, which is one of the reasons why many of them are laying off and cutting spending.

The fact that the current market capitalization is equal or lower than cash-in-hand is provides for an interesting market opportunity for private equity firms, others Insurtechs or traditional insurance carriers. Any of the above companies could buy these Insurtechs and get talent and intellectual capital for their organization and pay for the acquisition practically with the available cash at the Insurtech. Yes, they would have to integrate the Insurtech into their operations and improve their operational efficiency. But this seems like such a deal.

Carpe Diem

Robin Williams in the film Dead Poets Society urged his students to “seize the moment.” Are you ready? The byproduct of the current shifts in the public equity and VC financing markets, traditional carriers, MGAs and even other Insurtechs offers amazing opportunities. What are these opportunities?

- My former CEO at Citi had a strategy. If you find great talent, hire them, and figure out a role later. Hire top talent even if you don’t have a discernible need at the moment.

- If you have a hole in your portfolio, or if buying is better than building, consider making an unsolicited offer to those sitting on a mountain of cash.

- Keep up to date with the evolution of these Insurtechs -The main thing they are great at is developing new products and approaches. Be sure to stay in step with them, or even better, one step ahead of them.

As always, feel free to reach out to discuss this topic or anything else to do with the Insurtech landscape.

Insurtech Advisors helps regional carriers and agencies to collaborate with the best Insurtechs that will enable you to succeed and continue to meet the needs of your members, employees and independent agents. We know your company and the Insurtech landscape. We save you countless hours of wasted time and false starts. We also work closely with your team to identify opportunities and then introduce you personally to the best Insurtechs to pilot.

Kaenan is a professional in the areas of block chain, telematics, wearables, analytics, artificial intelligence (AI) and Insurtech. He has played a key role in innovating many start-ups and established carriers. His advice has been widely appreciated in the financial community, which resulted in multiple quotes and publications in various media.

Most recently he was Practice Lead for Innovation, Fintech, and Strategic Insights at EY. Throughout his career he has held leading roles within Marketing Strategy and Decision Management with top Insurance, Banking and Finance companies, including USAA, Citibank and Sallie Mae.