Insurtech Lemonade announced the results of the first quarter 2022 on Monday. I noticed two different comments in their shareholder letter, and you will see the result from this company perspective later when we discuss the results. In connection with the delay between pricing and regulatory approval, they spoke of a “structural nuisance.” Are they saying that the regulatory authorities and the insurance regulations are a nuisance? OK, perhaps inconvenient and frustrating, if we want to be honest, but certainly not a nuisance. Investors are lucky that they are not in commercial construction insurance. I’m not sure how they would ever assess the risk profile of a construction “structure” if the asset were considered a nuisance.

Loss ratios are lagging indicators, and improvements in pricing, underwriting and segmentations take time to get approved, and yet more time to ‘earn in.’ This lag between action and results is a structural nuisance in insurance (which is why we use predictive machine learning models, rather than backward looking loss ratios in our day-to-day management), though inflation has introduced an additional cost to this passage of time.

More interestingly, they found that predictive machine learning models are better than loss ratio analysis. This might explain why they are almost twice as likely to report a net loss for the quarter – a $75 million loss versus $44 million in revenue. They do not understand the fundamental relationship between loss ratio, expenses, and profitability.

The other comment they made, in the continuation of the above paragraph, was how happy they were to have filed 100 applications for rate changes over the past year. I’m not sure I would wave a flag and slam my chest if I had to admit that my pricing models were always so wrong!

Table of Contents

Lemonade 1Q2022 Results

As I have already mentioned, the public markets were not kind to all sorts of Insurtechs last year. Lemonade, the poster child of the sector, is trading below its strike price and has fallen by almost 75% in the last year.

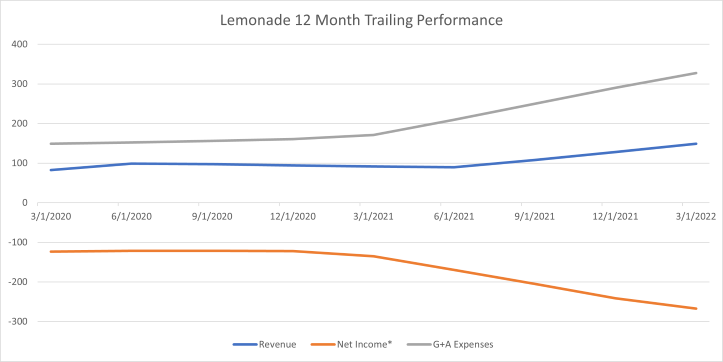

The following table attempts to hide quarterly volatility by looking at the trailing 12 months of results: While revenue increased by about 50% last year to an annualized rate of $149 million, spending on G & A has nearly doubled to $328 million, i.e., excluding loss expenses, Lemonade spends $2 for every dollar they take in, and over the past two years they have lost nearly half a billion dollars – $438 million; at a similar quarterly burn rate, they probably have only enough cash left to last just under two more years of operation.

Not all lemons make bad lemonade

Lemonade boasts more than 1.5 million customers, each paying about $279, which equates to an ongoing book of premium of $419 million. The loss ratio has dropped to 90 percent and they claim they are on track to reach 75 percent. However, they do not break out results according to their divisions, and it is hard to see how they will reach that level as they try to convert apartments renters to homeowner policies that have traditionally had higher loss ratios.

They point out that a customer in Illinois and Tennessee can now buy up to 4 policies and these customers spend 9 times more than a single product customer. This reminds me of the wake-up call Robin Williams used in his portrayal of DJ Adrian Cronauer in the 1960s – “Good Morning Vietnam.” I guess it’s never too late to wake up to what a legacy carrier like The Philadelphia Contributionship has known since it was founded by Benjamin Franklin in 1752. Multi-policy customers are better customers all around.

The decision to buy Metromile seems to have been a wise one: if we combine Metromile’s results with those of Lemonade, we can see a significant shift in the net loss trend. Indeed, the combined company could have recorded losses over the last three quarters, albeit still on an annual basis of $400 million. Similarly, the combination with Metromile has helped to mitigate the acceleration of G & A spending. (See the following table)

Does all this really matter?

Many of the regional and smaller national carriers I work with ask: “are these Insurtechs threats, and what should we do about them?” The answer is simple. It will be a long time before one of the current crop of Insurtechs has any chance of becoming a real competitive threat. It is more likely that one of your current competitors will take best practices from the Insurtechs and learn how to integrate them efficiently and effectively into their operating strategy.

The smart incumbent carriers learn from the Insurtech ecosystem and experiments with his own unique business and culture to see what works, what doesn’t and what moves the needle. Some even invest in some of the Insurtechs either directly or as part of a POC or venture capital company. Please reach out if you want to share lessons learned or have questions about what seems to work best.

Insurtech Advisors helps regional carriers and agencies to collaborate with the best Insurtechs that will enable you to succeed and continue to meet the needs of your members, employees and independent agents. We know your company and the Insurtech landscape. We save you countless hours of wasted time and false starts. We also work closely with your team to identify opportunities and then introduce you personally to the best Insurtechs to pilot.

Kaenan is a professional in the areas of block chain, telematics, wearables, analytics, artificial intelligence (AI) and Insurtech. He has played a key role in innovating many start-ups and established carriers. His advice has been widely appreciated in the financial community, which resulted in multiple quotes and publications in various media.

Most recently he was Practice Lead for Innovation, Fintech, and Strategic Insights at EY. Throughout his career he has held leading roles within Marketing Strategy and Decision Management with top Insurance, Banking and Finance companies, including USAA, Citibank and Sallie Mae.