When I think about 2021, the year was almost as crazy as 2020. It goes without saying that we all had to deal with the effects of Covid on ourselves, our families, colleagues, and work. I trust that you and those who are important to you finished the year healthy.

The Insurtech ecosystem in 2021 reminds me of two songs. “You’ll never walk alone” was originally composed by Rogers and Hammerstein in 1945 and sung by many people including Judy Garland, Roy Orbison, Elvis, and a more modern rendition by Andrea Boccelli. Keep on Truckin from the 1970s by Eddie Kendricks of Temptations fame sums up the world: Insurtechs were repeatedly kissed by VCs who became blind with the love for returns.

Although 2021 was a year of extremes more than anything else, whether it was severe damage from snow and ice, fires and heat, car frequency and severity claims, Insurtech funding; or Insurtech results, everything seemed upside down with conflicting results. But Insurtechs kept winning VC investments, and carriers kept looking to them as some form of salvation (o.k. maybe more like helping them innovate and improve their competitiveness… and AM Best Innovation Score!)

Table of Contents

Year of Storms: Physical and Viral

The NOAA reported that in 2021 there were 18 events that caused more than $1B of damage per event, with a reported total damage of $103B. NAIC reported that the total value of the P&C lines for 2020 was $725B, and if we extrapolate from 1H2021, the premiums will be approximately $790B in 2021, so these severe storms account for about 15% of the total premiums.

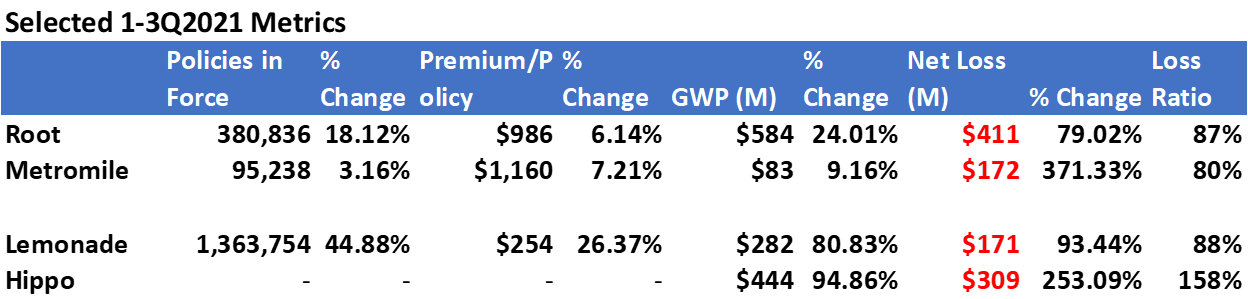

Hippo’s loss ratio was particularly influenced by their exposure to the Texas winter storm, with their loss ratio rising above 200% before leveling off to 158%.

With the relaxation of the Covid restrictions, Root’s loss ratio increased YOY by 16% to 87% in the first nine months of 2021. Metromile fared worse, as its YOY loss ratio rose from 59% to 80%.

Sugar or spice? Public Insurtechs looks spicy

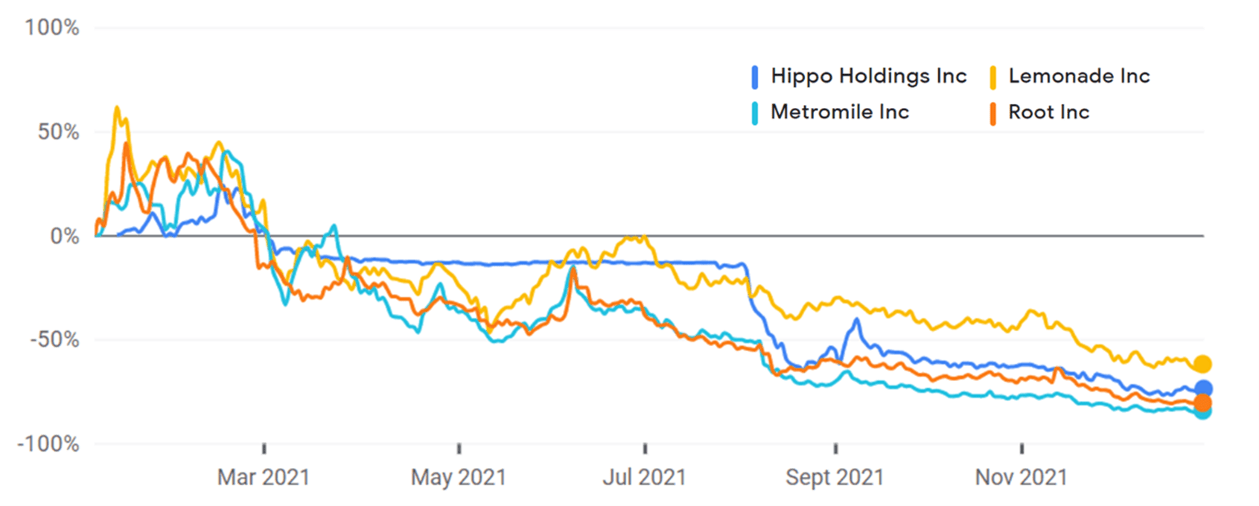

CNBC reported that 2 / 3 of all companies in all industries that went public in 2021 are below their IPO price, even more so for the 4 primary P&C Insurtechs that are public: Hippo, Lemonade, Metromile, and Root. Since the beginning of the year, Lemonade has faired the best of the lot by being only down about 60%, the other three are down in the range of 70%. (Chart 1)

These 4 Insurtechs did see significant growth in the first 3 quarters of 2021 in GWP, average policy amount, and the number of policies sold (Table 1: Selected 1-3Q2021 metrics). Hippo showed the highest increase in GWP, up 95% to $444M. Closely followed by Lemonade, which increased GWP to $282M, by 81%. The car Insurtechs grew slower than the homeowners Insurtechs with Root growing GWP 2.5 times faster than Metromile 24% vs. 9% with $584M and $83M respectively in GWP.

(Thanks to my Ivey School of Business intern Michael Lee for compiling this table)

Lemonade still has a relatively low average policy amount of $254 related to their persistently high number of renters, but they were able to increase their customer base to over 1.3M. This makes them more than three times larger in customers than Root and Metromile combined. Hippo reported no customer numbers. Speaking of combined. Lemonade has an agreement to purchase Metromile to jumpstart their step into auto insurance, ensuring that they have significant opportunities and the ability to cross-sell the auto market with renters/home and vice versa. And who knows, maybe even pet owners need to buy auto insurance from them to go to the veterinarian? 😊

While they have grown in size, it has been nothing like profitable growth. Overall, they have lost just over $1B in 9 months. In other words, for every dollar of premium, they lose 76 cents. This is not a combined ratio… this is a pure net loss. With the Metromile acquisition, Lemonade increased their net losses from $171M to $343M. According to Marketwatch, Lemonade has recorded a net income loss of $483M since its inception. They began the year with $571M cash that grew to $1B by June 2021. By September 2021, however, they had only $319 million of cash at their disposal, and at their current burn rate, the money each company has raised from its IPO will most likely be exhausted within 12 months.

The same scenario has played out in the health insurtech space. Three companies launched in 2021: Clover Health, Oscar Health, and Bright Health. All three showed stock prices that have plummeted since their IPO. Moreover, all three continue to bleed money. Clover lost $400M on just over $1B in revenue in the first three quarters of 2021. Bright Health reported a net loss of $371M in the first three quarters of 2021, and Oscar also recorded a net loss of $373M in the first three quarters of 2021 on revenue of $1.3B.

These underwriting losses have not been confined to the classic insurtechs. SiriusPoint, which operates as a front / reinsurer for insurtechs such as Vouch, Pie, Corvus, Outdoorsy, Rhino, Banyan Risk, LimitFi, Joyn, and others, reported a 20% decline in its share price this year. While they made a net profit of $161M in the first three quarters of this year, it included a loss of $60M in 3Q2021.

The Funding Anomaly

In keeping with Eddie Kendricks’s Motown theme, I worked for a dotcom called Urban Box Office Networks in 2000. One of its founders was the late former president of Motown, George Jackson. We raised over $40 million in a year to build an urban entertainment empire, including a network of websites that would compete with DoubleClick – yes, that was before Google’s dominance. Money flowed freely into the dotcoms. Alan Greenspan said… there was “irrational exuberance.”

Insurtech Funding in 2021 reminds me of the late dot-com era. Depending on whom you quote, either of the following were funding totals in the first 9 months of 2021:

$10.5B according to CB Insights and Willis Towers Watson

$15B according to Forrester

$39B according to Sonr

Whichever report you use, it has been a record year for Insurtech funding. This is particularly interesting given the poor performance of the public insurtechs.

M & A activity

One of the fastest ways to scale is for an insurtech to buy another company. We see this in two primary areas: 1) Insurtechs when transitioning from MGA to carrier by acquiring a “shell” carrier and 2) Insurtechs when buying other insurtechs. Moreover, mergers and acquisitions are more likely given the collapse in the share prices of some public companies, such as Lemonade’s purchase of Metromile last year.

But M & A or partnering is not only for Insurtechs but is happening even in the VC world. Eos Venture Partners, an Insurtech VC, and Twelve Capital, an investment manager specializing in the insurance industry, have teamed up to create a targeted fund to accelerate the digital revolution of the insurance industry by investing in the global Insurtech sector.

Ideas for 2022

While most of the venture capital went to carrier-type Insurtechs, a significant portion of the funding also went to enabling technologies. From improving the accuracy or speed of underwriting to reducing fraud, these Insurtech can help a regional carrier to compete with both the Insurtech carriers and the much larger traditional carriers.

If you are not already researching insurtechs in these areas, I would recommend that you start researching its relevance to your specific market.

- Agent enablement

- Agent analytics/behavioral analytics

- Property characteristic appended data

- Fraud analysis for SIU in particular

- Home /vehicle remote inspection and adjusting

- Value-added services/partnerships

Tried and True

Finally, if you are serious about keeping on top of the insurtech ecosystem and improving your ability to innovate, I strongly recommend that you set up a cross-functional committee of future leaders that meets monthly to follow and discuss potential business problems and opportunities where partnering with Insurtechs could accelerate the solution. The carriers that I support who do this are the ones who seem to better engage their future leadership, but more importantly, they evaluate and implement more solutions. Further allowing them to meet their mission of providing excellent service and products for their insureds.

Personal Note

Personally, I would like to thank all my clients for their continued support. It is a privilege to work with such a large group of people and carriers. Furthermore, this year, more Insurtechs and Brokers wanted additional guidance and advice than my historical interaction with them. I suspect this is because they see partnering as key to their success. I began to work more closely with Insurtechs, Brokers, and the VCs, and this has opened up a whole new perspective on partnership opportunities between all four major players in the broader Insurance ecosystem. Thank you! And I look forward to continuing to help.

May 2022 be a year of profitable growth, health, and continued friendship and support. Happy New Year!

Insurtech Advisors helps regional carriers and agencies to work with the best Insurtechs that will enable you to succeed and continue to meet the needs of your members, employees, and independent agents. We know your business and the landscape of Insurtech. We save you countless hours of wasted time and false starts. Furthermore, we work closely with your team to identify opportunities and goals, then introduce you personally and to the best Insurtechs pilot.

Kaenan is a professional in the areas of block chain, telematics, wearables, analytics, artificial intelligence (AI) and Insurtech. He has played a key role in innovating many start-ups and established carriers. His advice has been widely appreciated in the financial community, which resulted in multiple quotes and publications in various media.

Most recently he was Practice Lead for Innovation, Fintech, and Strategic Insights at EY. Throughout his career he has held leading roles within Marketing Strategy and Decision Management with top Insurance, Banking and Finance companies, including USAA, Citibank and Sallie Mae.