Today, Kin Insurance, an Insurtech with only $25 million in premiums in 2020 and an expected $98 million in 2021, announced its intention to go public today with a valuation of $1 billion. They are doing this by merging with the Omnichannel Acquisition Corp SPAC.

Interestingly, the SPAC is supported by celebrities such as NBA superstar Draymond Green, golf pro Rory Mcllroy, and cosmetics guru Bobbie Brown, who said that Kin, like her, would “reinvent” a market. Comments from the investor conference, as well as the following quotes from their SEC filing, suggest that Kin intends to use the SPAC’s expertise to help them continue to grow digitally.

“Matt Higgins, Chairman and CEO of Omnichannel, who also co-teaches a course on digitally native brands at Harvard Business School.”

“The Omni team is already hard at work helping elevate Kin’s brand presence, expanding Kin’s acquisition channels and layering in the most cutting-edge acquisition tactics.”

Kin’s success has been primarily in markets where carriers were less interested in writing policies like FL, LA, and to a lesser extent CA. As such, they benefited from an older average age of customers of 57 in a less competitive market.

Table of Contents

Kin’s Siblings: A Tail of Numbers

Kin believes that their “direct to consumer” model is fundamentally better than a commission-based agent model. In fact, according to their filing, it is 17% better. It allows them to manage the messaging and customer experience end-to-end, ultimately leading to higher retention rates of 92% and NPS 85. (More to follow)

Here are some of the key statistics Kin presented in the filing:

Reported Metrics

- Average Premium: $1,634 really $1,471, as they require a contribution of 10% to the reciprocal

- Retention Rate: 92%, but if you look at the premium retention 2020: 2021 it's 84%, and 2022E it's 85%

- Customer Acquisition Cost: They present two numbers, $312 and $500. Either way, it's at the upper end

- Lifetime Service Cost: 3.5% or $486 for customer service and unallocated loss adjusting expenses

- Loss ratio: 77% or 38% expected by 2023

- Combined Ratio: 154% for 2021 and 105% for 2023

- Reinsurance premiums: 28%

- Reciprocal Commission: 32%

They have created an interesting revenue / insurance model by creating a reciprocal exchange company that also levies a 10% premium on the premium to fund the exchange and pays Kin a 32% commission to generate and operate the business.

They indicate that they expect a loss ratio of 40% where they explain the reciprocal. They go from a reported loss ratio of 77% to the 40% loss ratio by taking into consideration hurricanes, rate increases and other underwriting changes. It is unclear how rate increases affect retention. We know that the insurance consumer has become very price sensitive. Moreover, the math barely adds up when you look at a 38% loss ratio, a 28% reinsurance premium, and a 32% commission. That right there is 98%. And it is very unlikely that Kin will be able to lower their loss ratio from 77% to 38% in 2 years, especially with a national expansion.

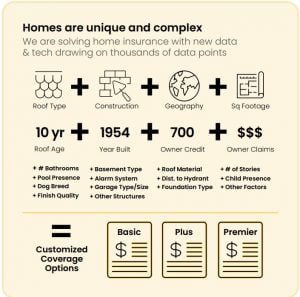

Kin’s Cousin: Data

What they emphasized during the investor talk and what I saw throughout the investor deck is a focus on data. Data to acquire leads, data to price leads, and data to work claims. In fact, they claim to use over 10,000 data points to generate the quote in real time. During the call, they mentioned the capability to dynamically adjust premiums depending on the weather. As an admitted product, especially in Florida, I found this comment surprising. That notwithstanding, they use data specifically to enhance their acquisition and book performance. And that is very compelling.

The KINdred Spirit of Legacy Has More Value

There are definitely things that a legacy carrier could learn from Kin. If done right, the legacy carrier will continue to dominate the landscape.

- Use data to your advantage to attract valuable and prospective clients, whether you are exclusively an agency channel, exclusively direct, or a mix. Help your agents identify strong leads, and you will only benefit.

- Use new external data sources such as Hazardhub, Fenris Digital, Betterview and others to expand and speed up underwriting, adding breeds of dogs, having a pool, zoning violations and other elements will only enhance your underwriting and pricing sophistication.

- Use remote inspection options such as Viewspection or Flyreel to help with initial underwriting, but also in claims adjusting.

- Focus on the claims experience by responding proactively and in real time through SMS, messaging, and other means. For example, if you know the course of a storm or fire, notify your customers as a preventive measure and track them immediately after the event. By doing these small things, you could even influence the percentage of claims that may be settled in court.

It is a great time to be a Carrier or MGA Insurtech that decides to go public. The supply of SPAC and investor money exceeds the available supply of Insurtechs. The Insurance world is seen by these investors as sleepy and ripe for disruption. What they don’t realize is that you are continuously innovative and have the confidence and experience to build long-term relationships with your agents, partners and customers. In fact, most of you have hundreds of years of history building solid profitable relationships.

Please reach out if you want to discuss Kin or some of the advances you could use to guarantee your continued growth and success.

Insurtech Advisors helps regional carriers and agencies to work with the best Insurtechs that will enable you to thrive and continue to meet the needs of your members, employees and independent agents. We know your business and the landscape of Insurtech. We save you countless hours of wasted time and false starts. We also work closely with your team to identify opportunities and goals, then introduce you personally to the best Insurtechs to pilot.

Kaenan is a professional in the areas of block chain, telematics, wearables, analytics, artificial intelligence (AI) and Insurtech. He has played a key role in innovating many start-ups and established carriers. His advice has been widely appreciated in the financial community, which resulted in multiple quotes and publications in various media.

Most recently he was Practice Lead for Innovation, Fintech, and Strategic Insights at EY. Throughout his career he has held leading roles within Marketing Strategy and Decision Management with top Insurance, Banking and Finance companies, including USAA, Citibank and Sallie Mae.