Table of Contents

The Root of Insurance is Profitable Coverage (Hint: A 63% 1st-year retention rate doesn’t help)

Insurtech Root, a mobile-first (only) carrier announced its intent to go public this week. Their SEC filing can be seen here. This comes on the heels of their latest funding round in 2019 of $350M at an estimated valuation of $3.65B with a total raised of $523M to date. And that wasn’t the only Insurtech M&A news this week. Bold Penguin announced it has acquired RiskGenius to leverage the data and analytics power of Risk Genius’s policy-level data approach (more below).

Root reported 2019 premiums of $450.1M and a net loss before taxes of $282.4M (Table 1). Losses represented 63% of DWP. Both premiums and losses increased dramatically since 2018 with direct premium increasing 323% from $106.4M and losses increased 309% from $69.1M in 2018. For the first 6 months of 2020, Root wrote $306.5M in DWP with a net loss of $144.5M. This reflects an improvement in their overall Loss to Premium ratio down to 47%, from 63% in 2020. However, much of this is driven by a reduction in what they call “Other insurance expenses” rather than actual accident loss expenses as seen by the increase in their Loss+LAE to premium ratio which increased during the first 6 months of 2020 to 74%.

Table 1: Financial Highlights

| 2018 | 2019 | Q1Q2 2020 | |

|---|---|---|---|

| Premium ($M) | 106.4 | 450.1 | 306.5 |

| Net Losses ($M) | 69.1 | 282.4 | 144.5 |

| Net Losses/Prem | 65% | 63% | 47% |

| Loss + LAE ($M) | 43.5 | 321.4 | 227.2 |

| Loss+LAE/Prem | 41% | 71% | 74% |

Root is currently licensed in 36 states and currently active in 30. They intend to be licensed in all 50 states by early 2021.

They have organized themselves as a full-stack carrier which they believe provides them greater product design flexibility and allows them to iterate faster than if they had gone the MGA route. In addition, they have launched a captive insurance agency, RIA. RIA allows them to sell partnership products like renters and earn a commission with no capital risk. Currently, they are working with Homesite to offer the renters product. They are seeing a 5.4% cross-sell success rate, which is lower than what other carriers see.

Reinsurance relationship

In addition, Root owns their own Cayman Islands-based reinsurance subsidiary, Root Re. Root Re’s primary sources of funds are capital contributions from the holding company, ceded insurance premiums and net investment income. This arrangement might provide Root with additional flexibility moving forward and allows them to benefit from the slight gains on deposits that the reinsurance entity can take vs. a traditional ceding of premium to an unaffiliated entity.

Unlike Lemonade (LMND) which is heavily reliant on reinsurance contracts, Root ceded only 18% of their premium to reinsurers. This is more in line with a traditional insurance model and more likely to provide them with greater reinsurance stability should their loss experience change for the worse.

Geographic footprint

Three states, Texas, Kentucky, and Georgia account for 41% of Root’s DWP, with the top 6 states accounting for 58% of DWP. They acknowledge that this concentration poses a risk to their performance if these states experience significant Catastrophe losses (or regulators begin to limit telematics data for pricing).

Table 2: Top States by DPW 2019

| State | $M DPW | % DPW |

|---|---|---|

| Texas | 94.7 | 21 |

| Kentucky | 46.5 | 10 |

| Georgia | 44.0 | 10 |

| Arizona | 26.7 | 6 |

| Pennsylvania | 25.2 | 6 |

| Ohio | 22.8 | 5 |

| Subtotal: Top 6 States | 259.9 | 58 |

Retention Rates

At first glance, Root’s first term retention rates look strong at 84%. However, when you factor in that underwriting declines 1/3 of them, their first term retention rate drops to 56.3% (Table 3). To their credit, these underwriting declines are typically for their worst drivers. In fact, the prospectus calls out that they decline 10% – 15% of applicants they deem as the riskiest drivers, which provides them a pricing advantage over an incumbent carrier.

Given this, they should expect lower-than average loss experiences because of selecting better drivers to underwrite. Their loss results don’t suggest this (discussed above).

When you factor in First and Second term retention rates along with underwriting declines, their 2-term retention rate falls to a very low 38%. This suggests they will need to continue to drive hard on new customer acquisitions which will continue to drive up their marketing expenses. Especially, as indicated above, they decline to write 10% – 15% of applicants upfront.

Table 3: Retention Rates

| Retention Rates | Rate |

|---|---|

| 1st Term | 84.0% |

| 2nd Term | 75.0% |

| U/W Declines Term1 | 33.0% |

| U/W Declines Term2 | 10.0% |

| Net Retention Term1 | 56.3% |

| Net Retention Term2 | 67.5% |

| 1st-year Overall Retention | 38.0% |

Quarterly Results

While Root’s YOY topline growth has been great, when we look at key metrics quarter-over-quarter, we see less consistency. Policies in force have been growing at double-digit rates averaging around 15% per quarter until Q2 2020, where their growth stalled. We see this stall also in DWP, with Q2 2020 showing a 15.4% decline in premium over Q1 2020 (attributed to decreased marketing activity due to the COVID Pandemic).

Table 4: Quarterly Results

| Quarter | Policies in Force | % Change | Premium /Policy | % Change | DWP ($M) | % Change |

|---|---|---|---|---|---|---|

| Q1 2019 | 176,179 | $770 | $88.7 | |||

| Q2 2019 | 220,536 | 20.1% | $805 | 4.3% | $99.2 | 10.6% |

| Q3 2019 | 242,631 | 9.1% | $877 | 8.2% | $119.5 | 17.0% |

| Q4 2019 | 281,310 | 13.7% | $904 | 3.0% | $143.7 | 16.8% |

| Q1 2020 | 334,209 | 15.8% | $889 | -1.7% | $164.2 | 12.5% |

| Q2 2020 | 334,327 | 0.0% | $909 | 2.2% | $142.3 | -15.4% |

COVID Impacts

Regulators in 13 states in which Root operates placed a mandatory moratorium on non-pay cancellations, providing consumers grace periods ranging from 30 days to 120 days in duration. These moratoriums resulted in a near doubling of premium write-offs from 2.8% during Q1 2020 to 5.4% for the Q2 2020.

The Root Advantage?

One thing is clear, Root plays in the direct-to-consumer space, currently primarily selling auto insurance, with a recent addition of renters insurance. However, within their prospectus, they seem to stress different aspects along the way, which might create tension as they try to be viewed as a technology company for IPO purposes, but an Insurance company for regulatory purposes:

“Root is a technology company revolutionizing personal insurance with a pricing model based upon fairness and a modern customer experience.”

“We are a direct-to-consumer personal auto insurance, renter’s insurance and mobile technology company which began writing personal auto insurance in July 2016 entirely through a smartphone mobile application. We market our products primarily through digital and referral program channels.”

Root identified the following key advantages they believe they have over traditional carriers;

- Pricing leverage because they solely rely on telematics to price and reprice policies. They intend to be the low-price leader.

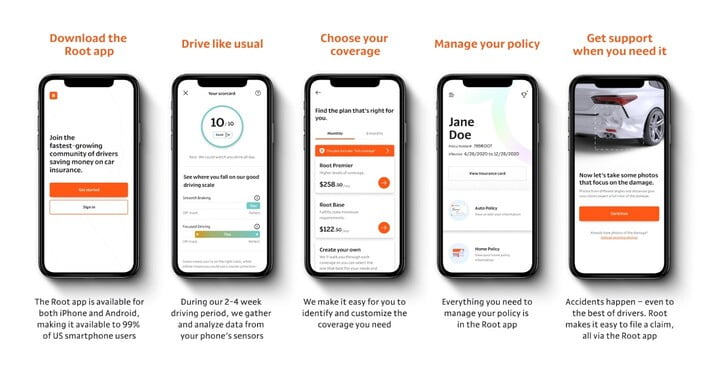

- They are mobile first and focused on simplifying the customer experience across the entire interaction channel (See Figure 1)

Figure 1: Root Customer Experience

What is unclear is how offering third party products play into what they view as their strengths. They have limited control over pricing and need to adapt their customer experience to the third party’s technology and application flow, which might not be as customer-friendly as their own.

What does the Root filing mean for you?

There are a few additional numbers that we see from their filing that highlight some of how they view themselves differently. The first is what they spend on software development, and the second additionally supports their positioning as a technology company. They invest heavily in computers and making their space conducive to recruiting Millennial talent.

- They spent $8.5M on software development costs in 2019. Up from $3M in 2018.

- They spent $3.5M on computers and $6M in leasehold improvements in 2019.

When thinking about their impending IPO, there are 5 constituencies that could be impacted. I’ll detail a few points below:

- Incumbent Carriers: A successful IPO will provide Root with additional free public relations, which will boost their brand awareness and most likely result in additional free or low-cost application flow. It is still too early to tell what the ceiling is for customer adoption of telematics-based insurance. It will also provide them with additional capital which they will deploy to improving and expanding their product set.

- Independent Agents: A growing direct-to-consumer brand with a price-driven message has the potential to erode the addressable market for agents. This will be particularly acute with Millennials.

- Reinsurers: To the extent that Root’s model of creating their own reinsurance entity proves successful and cost-efficient, other start-ups might choose to go that route, which will put downward pressure on growth opportunities.

- VC/Investors: If the IPO proves successful, and Root is able to grow their share price, this will drive continued interest in the Insurtech space, particularly for start-ups that are trying to create a full-stack carrier (or buy) an insurance company such as Pie or Hippo Insurance.

- Other Insurtechs: A successful IPO will mean we will see an increase in new Insurtechs following the path of becoming a full-stack carrier rather than an MGA. This will increase competition and likely result in a few strong Insurtechs that will dominate the start-up marketplace and public discourse.

How can carriers and agents compete with Root?

You need to make sure you are laser-focused on understanding your customer and their changing needs. You will need to test telematics and determine if there is broad appeal among your customer (and agent base) or rather specific segments. Do you start with the personal lines, commercial lines, or both? These are questions you need to answer based on your situation and needs.

If you don’t have a current telematics program, you will need to identify potential technology partners. Insurtech Advisors has worked with our clients to help them understand the telematics landscape and successfully partner with different providers. Each partner offers strengths and weaknesses which must be married up to your needs, capacity, and culture.

You should also explore using other technological advances coming out of the Insurtech space such as conversational AI, prefill, fraud detection, roadside assistance, and others. These advances will help you maximize your value to agents, policyholders, and staff.

Reach out if you want to discuss Root’s IPO or if there is anything else you are wondering about.

Bold Penguin Acquires Risk Genius

RiskGenius is an AI-driven, SaaS-based solution that applies machine learning to insurance policies. This allows carriers and agents to rapidly understand terms of coverage across a library of policy documents including policy review, compliance, competitive analysis, and emerging risk assessments.

It’s too early to know if Bold Penguin will be folding in RiskGenius’s technology into their platform or running the two companies separately. If they successfully integrate the policy-level analytics, it will allow agents and carriers who use the Bold Penguin platform to quickly understand the differences between the quoted policies and thus hopefully make more informed recommendations for their clients.

About Insurtech Advisors

Insurtech Advisors is dedicated to helping regional insurance carriers and agencies find and partner with Insurtechs enabling you to thrive and continue to meet the needs of your members and independent agents. We work closely with your team to identify opportunities and aspirations and then personally curate and introduce you to the best Insurtechs to pilot.

Kaenan is a professional in the areas of block chain, telematics, wearables, analytics, artificial intelligence (AI) and Insurtech. He has played a key role in innovating many start-ups and established carriers. His advice has been widely appreciated in the financial community, which resulted in multiple quotes and publications in various media.

Most recently he was Practice Lead for Innovation, Fintech, and Strategic Insights at EY. Throughout his career he has held leading roles within Marketing Strategy and Decision Management with top Insurance, Banking and Finance companies, including USAA, Citibank and Sallie Mae.