When I was a kid, I enjoyed watching reruns of “Leave It to Beaver.” The story that many of you may remember is about the Cleaver Family, with the near-perfect parents June, yes, the same as quarter-end ?and Ward Cleaver and their two sons, Beaver and Wally. They lived in two perfectly maintained homes, one on Mapleton Dr. and the other on Pine St. When I read Hippo’s 2Q22 Shareholder Letter, this series came to mind. One reason for this was the perfectly maintained houses, which Hippo identifies as their preferred market. These homeowners respond well to their holistic approach to homeownership and the role played by insurance. Even more so, the fact that a key theme of the show was that correct behavior brings rewards, while inappropriate behavior leads to less desirable consequences. Most Insurtechs did not understand this until recently.

Hippo has clearly begun to put the house back in order, and the quarterly results show this. They have begun to deal with the main mechanics of insurance: the adoption of rigor and profitability. Noteworthy is the fact that they reduced their loss rate excluding natural disasters last year from 62% in 2Q21 to 56% in 2Q22 10%) is remarkable. And given their increased geographic footprint, their overall loss ratio decreased 39% from 128% to 78% over the past year.

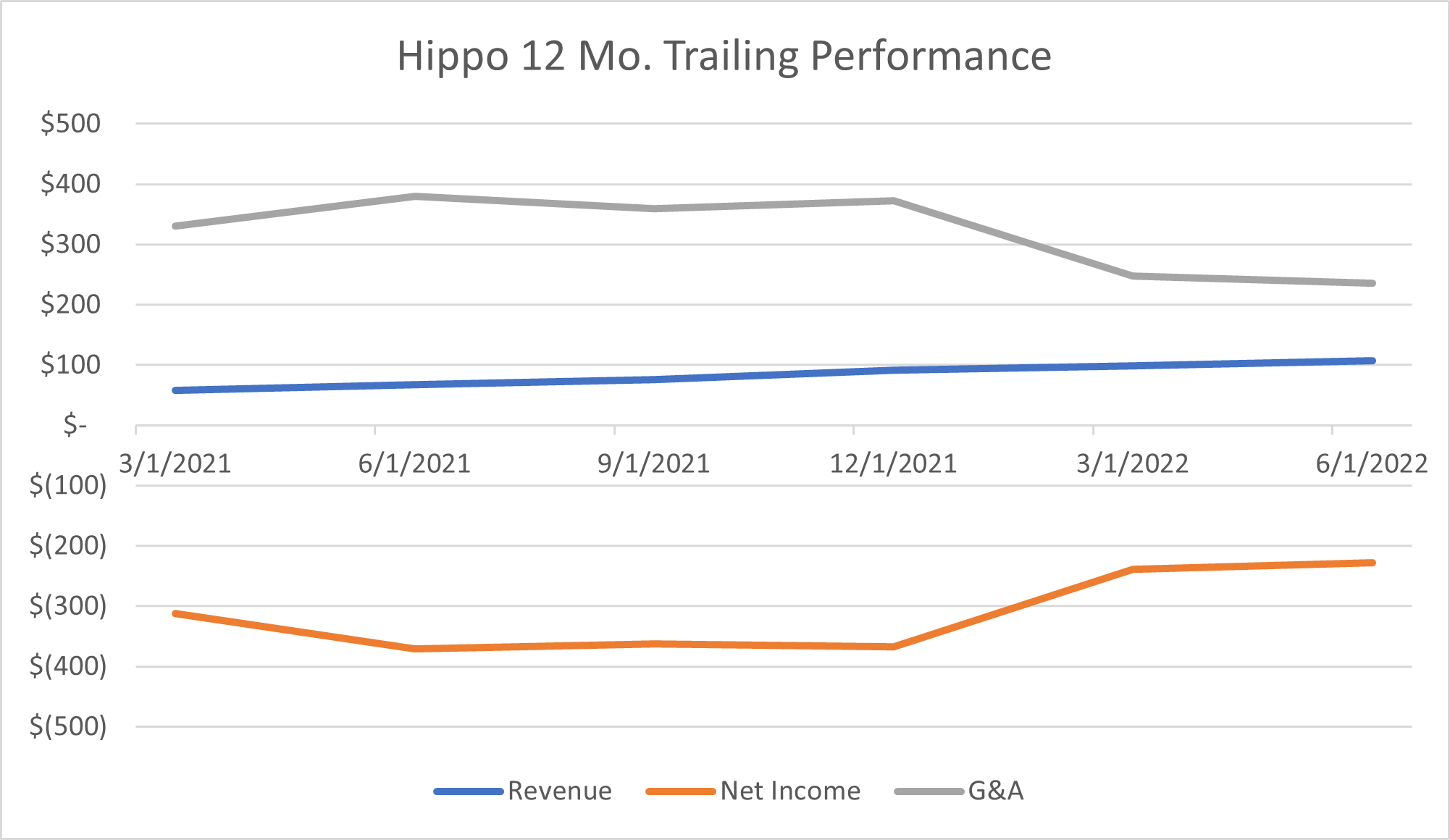

They grew premium in force 36% from 501M to 680M over the last year. Similarly, their subsequent twelve-month revenue increased by 60% from $67 million in 2Q21 to $107 million in 2Q22. However, their subsequent twelve-month net loss has fallen more slowly -39% than their revenue growth (from of ($371) million to ($228) million in 2Q21), suggesting that there is still much work to be done before they reach profitability.

Unlike Lemonade, Hippo and Root were able to reduce G & A spending, which led to a reduction in net losses thanks to improved loss control measures (rates, risk mitigation technologies and services, and better risk selection). Indeed, if they could double revenues over the next 18-24 months, keep spending somewhat flat, and stabilize and improve their loss ratios somewhat, they could become almost profitable.

The one metric Hippo is behind Lemonade and Root on is reflected in the amount they lose per dollar of revenue. Hippo loses $2.13 per dollar of revenue, Lemonade loses $1.63 per dollar of revenue, and Root loses only $1.16 per dollar of revenue. Calculated as trailing twelve months net loss divided by trailing twelve-month revenue.

Table of Contents

The value of innovation and breadth

When I look at the Insurtech ecosystem, I believe that Hippo is the best example of an Insurtech redefining a market segment. What do I mean by this? They have rethought not only the home insurance product but the role of a home insurance carrier. Hippo developed a product that more accurately reflects the needs and wishes of a modern homeowner – the cover for virtually everything and included standard. Problem with a sewer — covered, an appliance — covered. But, as we all know, prevention is even more important. So, they bought a home maintenance company and were able to recommend qualified trades people, and then introduced a mobile prevention service that could identify potential problems before they become insurance claims. They purchased a fronting carrier, Spinnaker, and an independent agent aggregator, First Connect. Except for a real estate company and a mortgage provider, Hippo has pretty much merged the most important components around home ownership.

Prevention and innovation are the backbones of Regional Carriers

Providing risk prevention is nothing new to regional carriers. For example, Mutual Assurance of Virginia has a program where they will come for a greatly reduced fee and install the whole-home Flo by Moen water leak detection and shut-off device. By arranging the plumbing in advance, both can guarantee the homeowner that it will be done right, but they greatly simplify the process and increase adoption and installation. Mutual of Enumclaw created a forest fire prevention program that is standard with their policies. Trained wildfire specialists will come out and help create a prevention zone and provide other damage mitigation services, and if necessary, come to fight a fire. Amerisure, a commercial provider carrier based in Michigan, places great emphasis on risk management to help its commercial policyholders prevent injury and damage before it occurs.

The lesson of June and Ward

One of the things that both carriers and Insurtechs can learn from June and Ward Cleaver is the importance of working together for the common good. This common good is a well-preserved house built on strong foundations. Moreover, as June has shown, serenity is a crucial element for success, regardless of what is going on in the house.

In this turbulent economic time, which puts pressure on all aspects of the insurance ecosystem, tranquility will determine the winners from the less fortunate. Furthermore, a focus on ensuring that the house is well maintained and functioning properly will be the key component Insurtechs and Carriers need if they are to continue to grow and prosper.

Please reach out if you would like to share your successes or delve deeper into any of the examples I discussed above.

Insurtech Advisors helps regional carriers and agencies to collaborate with the best Insurtechs that will enable you to succeed and continue to meet the needs of your members, employees and independent agents. We know your company and the Insurtech landscape. We save you countless hours of wasted time and false starts. We also work closely with your team to identify opportunities and then introduce you personally to the best Insurtechs to pilot.

Kaenan is a professional in the areas of block chain, telematics, wearables, analytics, artificial intelligence (AI) and Insurtech. He has played a key role in innovating many start-ups and established carriers. His advice has been widely appreciated in the financial community, which resulted in multiple quotes and publications in various media.

Most recently he was Practice Lead for Innovation, Fintech, and Strategic Insights at EY. Throughout his career he has held leading roles within Marketing Strategy and Decision Management with top Insurance, Banking and Finance companies, including USAA, Citibank and Sallie Mae.